The Greatest Guide To Offshore Banking

Table of ContentsOffshore Banking Things To Know Before You BuyWhat Does Offshore Banking Do?The 25-Second Trick For Offshore BankingThe Main Principles Of Offshore Banking Offshore Banking Things To Know Before You BuyOur Offshore Banking DiariesThe Ultimate Guide To Offshore BankingFacts About Offshore Banking RevealedThe Single Strategy To Use For Offshore Banking

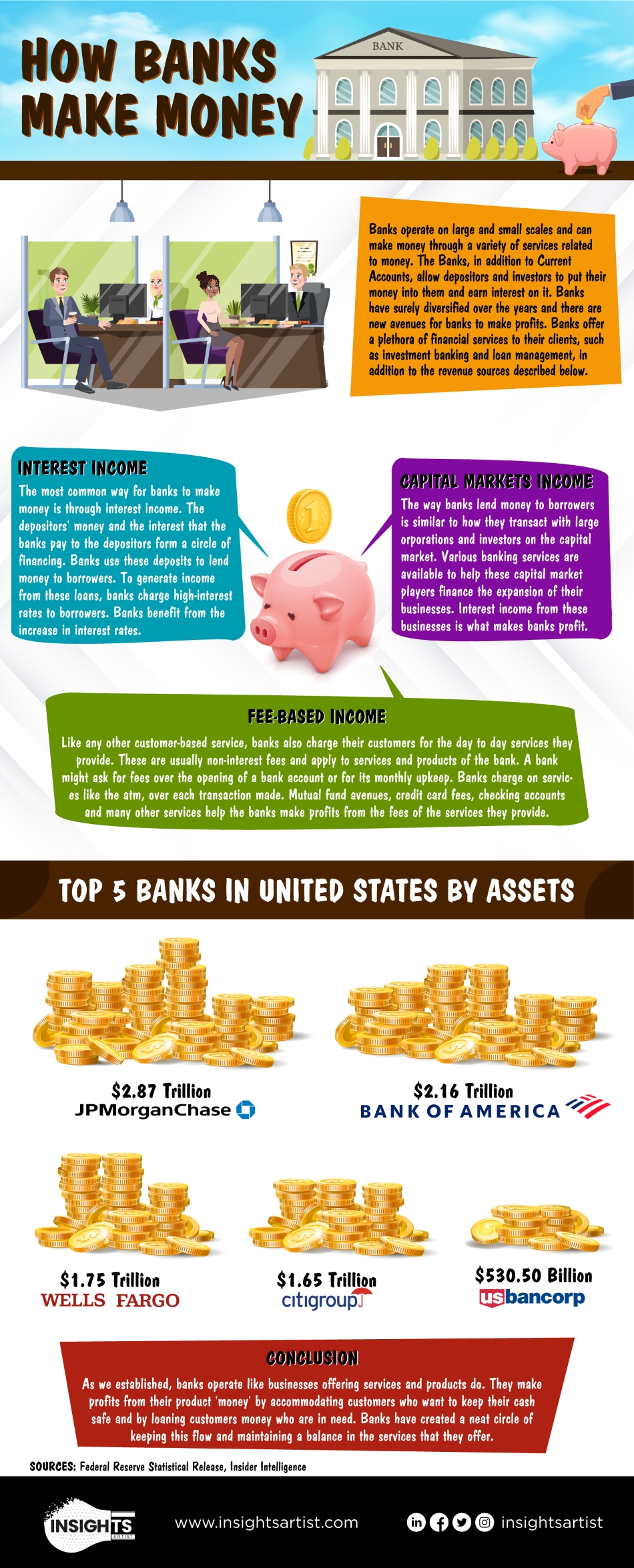

Banks do this by charging even more rate of interest on the fundings and various other financial obligation they issue to debtors than what they pay to people that use their cost savings lorries.

Getting My Offshore Banking To Work

Banks earn a profit by charging more rate of interest to debtors than they pay on financial savings accounts. A bank's size is identified by where it is situated and also who it servesfrom little, community-based organizations to big industrial financial institutions. According to the FDIC, there were just over 4,200 FDIC-insured commercial financial institutions in the USA since 2021.

Standard banks use both a brick-and-mortar place and also an on the internet existence, a brand-new trend in online-only financial institutions emerged in the early 2010s. These financial institutions typically offer customers higher rate of interest and also reduced charges. Comfort, rate of interest, and fees are some of the variables that help consumers choose their favored financial institutions.

A Biased View of Offshore Banking

This website can help you locate FDIC-insured financial institutions and branches. The goal of the Stocks Financier Protection Corporation (SIPC) is to recoup cash money and safety and securities in case a participant broker agent firm falls short. SIPC is a not-for-profit firm that Congress developed in 1970. SIPC shields the clients of all registered brokerage firm companies in the united state

Excitement About Offshore Banking

You need to consider whether you intend to keep both company as well as individual accounts at the exact same bank, or whether you desire them at different banks. A retail financial institution, which has fundamental banking services for consumers, is one of the most proper for everyday financial. You can pick a typical bank, which has visit this site right here a physical structure, or an on the internet bank if you do not want or require to physically see a financial institution branch.

A neighborhood bank, for instance, takes deposits and also offers locally, which can offer a much more tailored banking relationship. Select a practical place if you are selecting a bank with a brick-and-mortar area. If you have an economic emergency, you don't wish to have to travel a cross country to get cash money.

Offshore Banking Fundamentals Explained

Some financial institutions additionally offer smartphone applications, which can be useful. Examine the fees related to the accounts you wish to open up. Banks charge interest on loans as well as month-to-month upkeep costs, over-limit charges, and wire transfer costs. Some huge financial institutions are transferring to finish overdraft account costs in 2022, to ensure that can be an essential consideration.

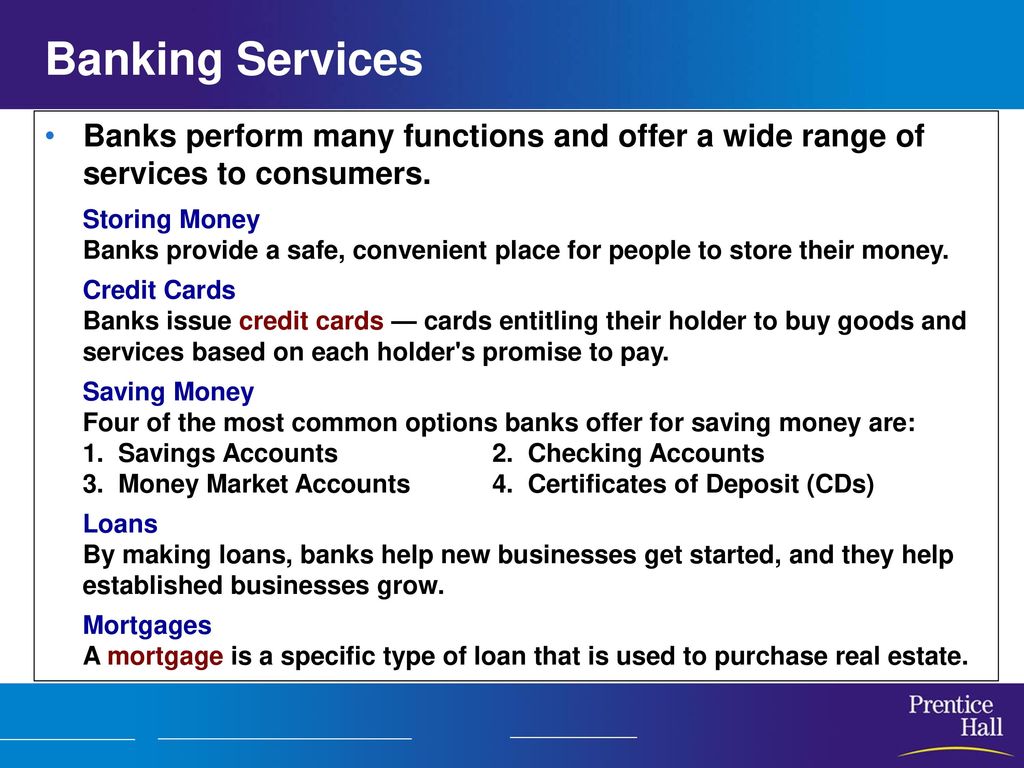

After making some low reductions (in the form of payment), the financial institution pays the expense's value to the holder. When the bill of exchange grows, the bank gets its payment from the party, which had actually approved the expense. Financial institutions supply cheque pads to the account holders. Account-holders can draw cheques upon the bank to pay cash.

Things about Offshore Banking

Banks help their consumers in transferring funds from one place to another through cheques, drafts, and so on. A credit scores card is a card that permits its holders to make acquisitions of products and solutions in exchange for the charge card's company promptly paying for the products or solution. The cardholder debenture back the purchase total up to the card provider over some time and with interest.

Mobile banking (additionally known as M-Banking) look at here is a term used for performing equilibrium checks, account deals, settlements, credit history applications, and various other financial transactions through a mobile phone such as a smart phone or Personal Digital Assistant (PERSONAL ORGANIZER), Approving down payments from savers or account owners is the primary function of a financial institution.

Offshore Banking - An Overview

Individuals choose to deposit their savings in a financial institution since by doing so, they earn passion. Concern financial can include a number of numerous solutions, yet some prominent ones include complimentary monitoring, online costs pay, financial appointment, and details. Personalized monetary and also financial solutions are commonly used to a financial institution's digital, high-net-worth individuals (HNWIs).

Personal Banks intend to match such individuals with one of the most ideal choices. offshore banking.

Unknown Facts About Offshore Banking

Not only are cash market accounts Federal Down payment Insurance coverage Corporation-insured, yet they earn greater rate of interest than examining accounts. Money market accounts lessen the threat of spending due to the fact that you always have accessibility to your money you can withdraw it any time scot-free, though there might some restrictions on the number of purchases you can make monthly - offshore banking.

Company financial generally gives greater revenues for financial institutions because of the big amounts of cash and rate of interest included with company financings. Sometimes both departments overlap in terms of their solutions, yet the actual difference remains in the clientele as well as the profits each financial type earns. A business lender works carefully with customers to establish which financial services and products best fit their requirements, such as company bank account, charge card, treasury management, fundings, also settlement processing.

3 Easy Facts About Offshore Banking Shown

You desire to choose a financial institution that supplies a complete array of solutions so it sustains your financial requires as your business expands. ACH permits cash to be moved digitally without using paper checks, see this here cable transfers or cash.